🔥 Burn Detector

The Burn Detector is a specialized module that monitors and alerts users when LP (Liquidity Pool) tokens are burned. It provides clear insights into the security of the liquidity pool, indicating its protection from liquidity removal and signaling potential bullish sentiment when developers burn their own funds to support the token’s success.

What is LP Token Burning?

LP token burning is the process of sending LP tokens to a dead (null) wallet. This action permanently removes the developer’s ability to withdraw liquidity from the pool. In other words, once LP tokens are burned, developers lose access to liquidity provider functions that could otherwise be used to drain liquidity.

What the Burn Detector Shows

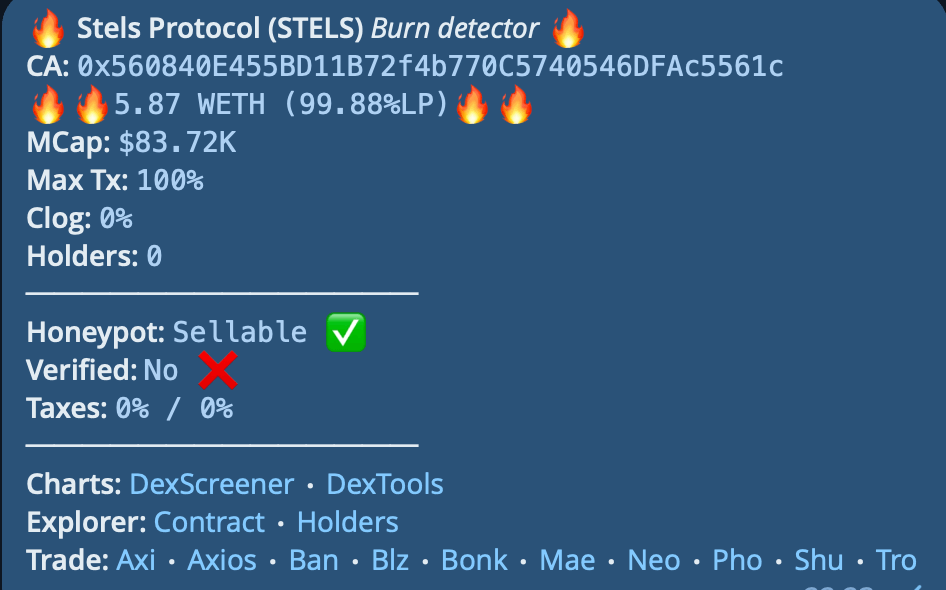

When a burn event is detected, the module displays detailed information, including:

- 🔥 Burn Amount: The value of LP tokens in Ethereum (e.g., 5.87 WETH)

- 💧 Liquidity Pool Burn: Percentage of LP tokens burned (e.g., 100% LP)

- 💰 Market Cap: Current market capitalization of the token

- 📊 Max Transaction: Maximum transaction limits

- 🚫 Clog: Percentage of supply from tax clogged in the contract

- 👥 Holders: Number of unique wallet addresses holding the token

- ✅ Security Checks: Honeypot detection and contract verification status

- 💸 Taxes: Buy and sell tax percentages

Why LP Token Burning Matters

LP token burning is a critical indicator for traders and investors, offering insights into a project's stability, security, and long-term potential. Here’s a deeper look at why it’s so important:

1. Enhanced Security and Trust

When developers burn LP tokens, they are taking a significant step towards securing the project's liquidity. By sending the LP tokens to a dead address, they are giving up their ability to directly withdraw the initial liquidity from the pool. This action can be a strong indicator of the developer's commitment to the project and can help to build trust with the community.

However, it is crucial to understand that LP token burning is not a 100% guarantee against all forms of malpractice. For a more detailed explanation of the potential risks, please see the Limitations and Risks section below.

2. Bullish Signal

A significant LP burn is often interpreted as a bullish signal. It demonstrates that the development team is committed to the project's long-term success, as they have willingly given up control over a substantial portion of the project's funds. This commitment can attract more investors, drive up demand, and positively impact the token's price.

3. Scarcity and Value

Just like regular token burns, LP token burns contribute to scarcity. By taking a portion of the LP tokens out of circulation, the overall supply is reduced, which can lead to an increase in the token's value over time. This is especially true if the demand for the token continues to grow.

Actionable Insights

- Verify the Burn: Always verify the burn transaction on a blockchain explorer to ensure that the LP tokens have been sent to a dead address.

- Assess the Percentage: A 100% LP burn is the gold standard, but even partial burns can be a positive sign. Assess the percentage of the burn in relation to the total liquidity.

- Combine with Other Indicators: While a significant LP burn is a strong positive signal, it should not be the only factor in your investment decision. Always combine this information with other fundamental and technical analysis.

Limitations and Risks

While LP token burning is a positive sign, it does not offer a 100% guarantee against all types of "rug pulls" or malicious activities. Here are some critical risks to be aware of:

- Hidden Mint Functions: A developer can still potentially drain the liquidity pool if the token contract contains a hidden mint function. This function would allow them to create a large number of new tokens, which they could then sell on the open market, effectively clearing out the liquidity pool.

- Contract Ownership: If the ownership of the token contract has not been renounced, the developer still maintains control over the contract. This means they could potentially make changes to the contract, such as disabling selling, creating a honeypot scenario.

Therefore, it is crucial to conduct a comprehensive analysis of the token contract before making any investment decisions. Always check for hidden mint functions, verify that the contract ownership has been renounced, and look for any other potential red flags in the contract code.